|

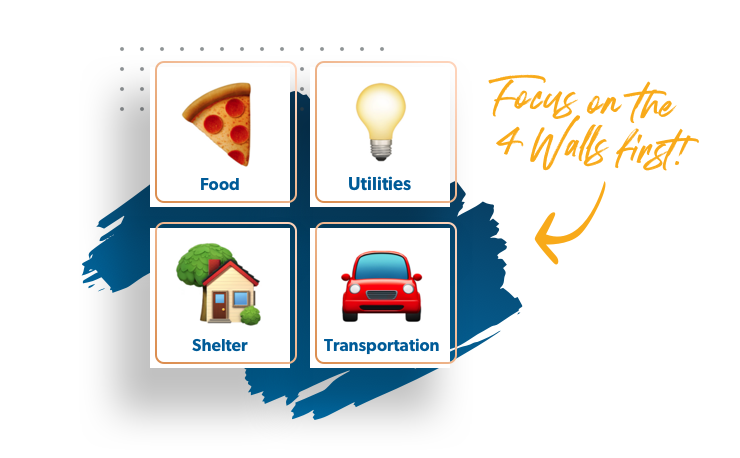

The 4 Walls

Many of us are eager to work on success and career building! And yes, please do. But before you step up on that mountain, get your base camp of the Four Walls together, or you will never make the climb. Getting your household in order first gives you stability, and breathing room. When your Four Walls are in jeopardy, that means crisis. And a lot of Americans prioritize the cable or a brand new phone over the 4 Walls. And we wonder why the average person is $50,000 in debt? Time to get back to basics. What are the Four Walls? They are the basics of survival: food, shelter, transportation & utilities. They can also include necessary clothing. The Four Walls help us meet our basic needs, experience comfort, and create the mental clarity necessary to begin to strategize for the future. When your lights and water are about to be cut off, or you don't have a place to live, it is stressful. You can avoid that with proper planning. Write down on a piece of paper how much money you bring in each month. Then write down how much each of these Four Walls cost: Food, Shelter, Transportation, and Utilities. Then divide each wall by your monthly income to get the percentage each wall takes up of your total pay. For the time being, don't worry about paying on credit cards or other collectors. They are not as important as your Four Walls. You can deal with your credit score later, when your life is stabilized. 1. Food, 5-15%. Food is your first wall. This is crucial. You gotta feed yourself. Ideally food will take up 5-15% of your take-home pay. If it doesn't, don't beat yourself up. You are not alone! Many families are spending astronomical amounts on food. I just spoke with a couple a few weeks ago who found out they were spending $1500 on food, simply because they were not paying attention. Start shopping at the discount stores(yes, they carry organics!), meal plan, eat cheaper items(can you say, rice and beans?) and if your income is below the poverty line, consider food stamps. It is very possible to rein in food costs when you start being intentional. I cut my grocery budget in half simply by meal planning & shopping at the discount stores. 2. Shelter, 25-35%. The second wall is shelter, or housing. Having a roof over your head and a place to sleep that is comfortable and safe brings relief. The recommended percentage for this category is 25-35%. The reason for this is that housing is the place most people overspend, and that keeps them from being able to build any wealth. When I first moved to my new town, I was grateful for a safe home for myself and my children. However, that home took up 50% of my income, so I had little leftover to cover food, debt payments, utilities & transportation. Many people in this inflated housing market are paying very high costs for rent. I recommend getting roommates, doing airbnb, downgrading your rent, or even selling your home if your rent/mortgage is too high of a percentage. Do a house hack! It's an incredible feeling when you can cover your housing and then have money left over to save, give, and spend! 3. Transportation, 10-15%. Required transportation is your third wall. This means the kind of transportation you need to get to work, get to the grocery store, and get your kids where they need to go. Not transportation to take a vacation that you put on the credit card. Not a new car that you lease, or borrow money for. This means basic transportation: bus, train, or car. The recommended percentage is 10-15%. When you are getting started in life it’s okay to drive a beater car, take the bus, or get rides until you can afford upgraded transportation with cash. 4. Utilities, 5-10%. The fourth wall is utilities: lights, water, electricity, sewer, garbage. What it takes to keep your household comfortable in hot or cold weather. Again, if you are in crisis this is the basics, not the fancy version. Can you get a $50 air conditioner off of Craigslist in the summer? Can you conserve energy by turning off lights and taking shorter showers? You probably know the ways you can be more energy-efficient already. Actually in my experience most folks are paying decent prices for their utilities, but sometimes don't prioritize them right. Be sure and pay your light bill before your personal spending or your credit cards! Now you have a good look at your Four Walls and their percentages. If the percentages are way out of whack, or if your Four Walls alone are more than your take-home pay, this may be a time to make some hard decisions about where you spend your money. Time to cut someplace, and make more money. Time to cover the basics. I can assure you, when your Four Walls are covered, you will breathe easier. And then you will be able to look up from survival mode, and begin to set your sights on success.

0 Comments

Leave a Reply. |

Details

Kathy KaliCoach. Teacher. Author. Speaker. Archives

March 2024

Categories |

RSS Feed

RSS Feed