|

Okay, friends: HERE’s the PIVOT! I’m so excited! Since last year I have been researching how to help women build wealth without burning MYSELF out. It is what I need now, after all, in menopause. I REQUIRE good income, part-time work, ease & grace... Meeting with my own counselors & coaches, I began to see the light dawning… There is something I have ALREADY been doing ANYWAY for years. It is so easy, natural and fun for me, I didn’t even see it: Creating homes for people through real estate investing! We have unique circumstances. My husband is 22 years older than me, and we started investing late. We have both owned many properties over the years, but we have focused on real estate exclusively for his retirement over the last decade. The returns are higher for short time frames like ours than the socially responsible mutual funds normally I would recommend for folks my age(51). Also, we are “hands-on” people who tend to remodel and add value. The profit comes when we provide something nicer for someone than what existed previously. And that feels great! *We have done A LOT ALREADY to create nice homes for people: SIX renovations & flips that we sold at affordable prices, TWO rental units that we bought & renovated, ONE home we bought for someone we love, and we are now purchasing our THIRD “buy and hold” unit which will soon be renovated to add value. Out of the 10 transactions we have done, I have found 9 of them myself. *I LOVE researching real estate, creating spreadsheets, crunching numbers, making contracts with tenants, etc.(I do this all the time even when I'm not being paid, and love putting together "deals") *I have been a landlord/property manager in some capacity for 12 years, and am familiar with leases and Fair Housing laws. *I have always created welcoming space in homes, and when I turned 50, many of my friends said I had helped them find a home in some way! "After" photo from a project in 2021: Paint, Pergo & New Kitchen Cabinets *I have served on the Ashland Housing Committee for 3 years studying the City’s process for supporting housing. *After the Almeda Fire destroyed thousands of homes in our area I worked for the non-profit Zone Captains helping connect people who lost their homes with home replacement grants. *We are mindful to support affordable housing~while we do midterm rental at our 2 unit so that we may keep it as a primary residence, we are leaning into longterm rentals for future projects in order to preserve housing for working people in our area. *We bought a mobile home for someone we love who had a health challenge and was experiencing housing insecurity. *We are super inspired by friends who maintain longterm affordable housing units, including Monique & Nick Lee who own 20 units and are now partnering with Age+ to provide affordable senior housing! *Significantly, all of my Vision Boards over 30 years have had homes in them. *AND…this gives me chills: someone once told me what our mothers were doing with us in the womb is a key to our life purpose. My Mom was LOOKING FOR A HOME and FOUND IT while pregnant with me! SO….the step to my next career move was right under my nose! Intriguing and amazing. "After" photos from a project in 2022: Paint, Pergo, & New Furnishings. If you know me, you know I always love to teach and share what has helped me. I am now offering private coaching & group mentorships to teach women the general principles & strategies of real estate investing. During this process I help them shop for their next property, and make sure the numbers make sense. My 18 years of Money Coaching is an extra “tool” in my toolbox to help women do financial “fine-tuning” to get ready to make their next investing move. (And I am well versed in the "hoop-jumping" required for self-employed borrowers to get loans!) To be clear, I am NOT a realtor, though I love to work with realtors to close transactions! I am an investor and a coach. Please feel free to book a call or hop on my email list if any of this sounds interesting to you and thank you friends so much for your support! And if any investor-friendly real estate agents want to reach out, please do as well. It has always been my passion to see women prosper, and real estate is a great way to do that!

0 Comments

This is a story about where the Conscious Living Fair came from.....the Lotus Moon Temple. I created the Conscious Living Fair in Ashland, Oregon to help holistic entrepreneurs grow their businesses with 5 events, each with 60 vendors & 300 attendees in high-end hotels in the Ashland and Eugene area. But this time, in 2023, I decided to renew the Fair in a more intimate space. Why? Why not go back to the big hotels? Well, I'm getting back to my roots. When I lived in Williams 20 years ago I created a home studio space called the Lotus Moon Temple on the 8 acre property I shared with my first husband. We ordered the kit and had a local contractor assemble it with a foundation, drywall, and beautiful wood finishes. I taught tantric dance and prosperity classes out of that space for years. It was the start of my 17 year money coaching practice(www.kalicoaching.org). My daughter was born in the space, with doctor & midwife overseeing. Both my kids played and had fun in and around the beautiful wooden yurt. Our local Waldorf school had our founding board meetings there. And bodyworkers used the space for healing sessions. This is where the Conscious Living Fair was born...I hosted an event in the Temple 5-10 times called the Women's Pampering Benefit. The Benefit had about 5 practitioners sharing their healing arts, and we raised money each time for a local charity. It was a delicious event, and a lot of fun! At this time I had a transformational coach with a background in Werner Erhardt/Landmark work, and New Thought prosperity teachings from the Unity Church, Science of Mind, Kabbalah, and Christian Science traditions. She helped me grow businesses & income, practice giving(this is when my practice of giving 10% of my income away started!), and hold space for community events. In my money classes I taught the money mindset methods I learned from her. She had many complex writings on the topic(www.wonderworks.org) The way I have used them in my life is a system I have created called the Principles of: Generosity, Integrity, Gratitude, Intention, Supportability & Trust. Here is a picture of the space set up for a tantric dance movement meditation practice with women. I am so thankful the Lotus Moon space gave me the foundation to start a high-level Tantric Dance women's empowerment program in Seattle. I traveled up there once a month to work for 8 years, and help my kids see their grandparents. All this growth was great, but it put strain on the marriage. We tried counseling, but eventually decided to go our separate ways. In 2013 I moved to Ashland as a single mom to start my life anew in 2013. My divorce was final on December 21, 2012, which was the long-anticipated New Year in the Mayan Calendar. That seemed significant! In Ashland, I got a new coaching Certification with Dave Ramsey(www.ramseysolutions.com) whose team taught practical tools to not just make money, but also save and invest for wealth-building. I revived my music business and played in retirement communities from Eugene to Redding. And I coached others to dump debt and build wealth, while still giving 10% away. My money coaching grew, and students got BIG results in their net worth! And since many of my money clients had holistic businesses(your massage therapist, your counselor, etc.), I founded the Conscious Living Fair to help them! The Fair at the Ashland Hills Hotel was a big event that helped many people. I am proud to have created it. And I was grateful for the support of my second husband, who has been by my side for a decade, since 2013. The Fair has been re-newed now, starting Summer 2023! But my nervous system now is more sensitive than it was. I don't enjoy hosting such huge events anymore. I crave intimacy, depth, and quieter spaces where relationships can be built and healing transformations happen. Plus, I love to get pampered too! A cozy space with more massage is just what I like! I knew I had to find a different location for the Fair. So that's why Conscious Living Fair is now at Lithia Loft, a gorgeous boho-chic space right in downtown Ashland! And I couldn't be happier. With 10-15 vendors, and beautiful sumptuous decor, the space is like a cross between the Ashland Hills hotel and where everything started.....the Lotus Moon Temple. I will be there with my Money Coaching booth, among all the other AMAZING practitioners! Our first event is July 29th 2023, and then once/month thereafter.

(August 12, September 9, October 14, November 11, December 16, and more in 2024.....) Hope to see you there! love, Kathy The 4 Walls

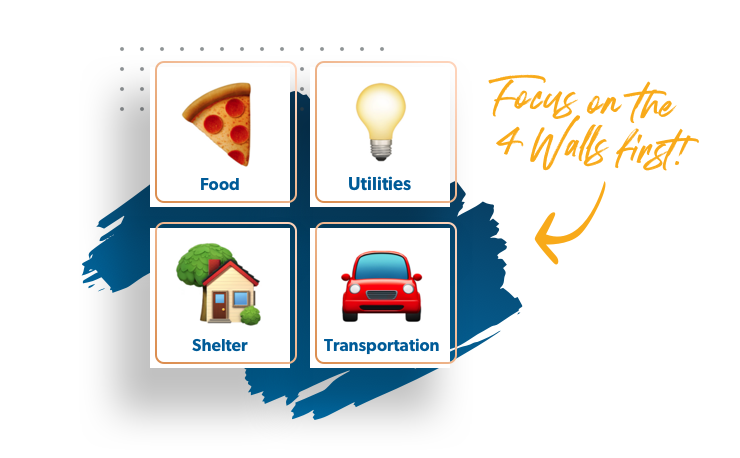

Many of us are eager to work on success and career building! And yes, please do. But before you step up on that mountain, get your base camp of the Four Walls together, or you will never make the climb. Getting your household in order first gives you stability, and breathing room. When your Four Walls are in jeopardy, that means crisis. And a lot of Americans prioritize the cable or a brand new phone over the 4 Walls. And we wonder why the average person is $50,000 in debt? Time to get back to basics. What are the Four Walls? They are the basics of survival: food, shelter, transportation & utilities. They can also include necessary clothing. The Four Walls help us meet our basic needs, experience comfort, and create the mental clarity necessary to begin to strategize for the future. When your lights and water are about to be cut off, or you don't have a place to live, it is stressful. You can avoid that with proper planning. Write down on a piece of paper how much money you bring in each month. Then write down how much each of these Four Walls cost: Food, Shelter, Transportation, and Utilities. Then divide each wall by your monthly income to get the percentage each wall takes up of your total pay. For the time being, don't worry about paying on credit cards or other collectors. They are not as important as your Four Walls. You can deal with your credit score later, when your life is stabilized. 1. Food, 5-15%. Food is your first wall. This is crucial. You gotta feed yourself. Ideally food will take up 5-15% of your take-home pay. If it doesn't, don't beat yourself up. You are not alone! Many families are spending astronomical amounts on food. I just spoke with a couple a few weeks ago who found out they were spending $1500 on food, simply because they were not paying attention. Start shopping at the discount stores(yes, they carry organics!), meal plan, eat cheaper items(can you say, rice and beans?) and if your income is below the poverty line, consider food stamps. It is very possible to rein in food costs when you start being intentional. I cut my grocery budget in half simply by meal planning & shopping at the discount stores. 2. Shelter, 25-35%. The second wall is shelter, or housing. Having a roof over your head and a place to sleep that is comfortable and safe brings relief. The recommended percentage for this category is 25-35%. The reason for this is that housing is the place most people overspend, and that keeps them from being able to build any wealth. When I first moved to my new town, I was grateful for a safe home for myself and my children. However, that home took up 50% of my income, so I had little leftover to cover food, debt payments, utilities & transportation. Many people in this inflated housing market are paying very high costs for rent. I recommend getting roommates, doing airbnb, downgrading your rent, or even selling your home if your rent/mortgage is too high of a percentage. Do a house hack! It's an incredible feeling when you can cover your housing and then have money left over to save, give, and spend! 3. Transportation, 10-15%. Required transportation is your third wall. This means the kind of transportation you need to get to work, get to the grocery store, and get your kids where they need to go. Not transportation to take a vacation that you put on the credit card. Not a new car that you lease, or borrow money for. This means basic transportation: bus, train, or car. The recommended percentage is 10-15%. When you are getting started in life it’s okay to drive a beater car, take the bus, or get rides until you can afford upgraded transportation with cash. 4. Utilities, 5-10%. The fourth wall is utilities: lights, water, electricity, sewer, garbage. What it takes to keep your household comfortable in hot or cold weather. Again, if you are in crisis this is the basics, not the fancy version. Can you get a $50 air conditioner off of Craigslist in the summer? Can you conserve energy by turning off lights and taking shorter showers? You probably know the ways you can be more energy-efficient already. Actually in my experience most folks are paying decent prices for their utilities, but sometimes don't prioritize them right. Be sure and pay your light bill before your personal spending or your credit cards! Now you have a good look at your Four Walls and their percentages. If the percentages are way out of whack, or if your Four Walls alone are more than your take-home pay, this may be a time to make some hard decisions about where you spend your money. Time to cut someplace, and make more money. Time to cover the basics. I can assure you, when your Four Walls are covered, you will breathe easier. And then you will be able to look up from survival mode, and begin to set your sights on success. I turn 50 this year. And am in the thick of menopause.

So my "bullshit" meter is off the charts. You mean in detecting others' bullshit? I suppose that is true sometimes. Haha! But mainly, I'm tuned in to my own bullshit. I can now see where I feel uncomfortable, stressed, out of integrity, or fake, much more quickly. I see where I overwork, try to please others, and ignore my inner guidance from God. I find I have to meditate every day, to bring me back to center. To my own place of inner peace. The 10 years I spent practicing a slow form of yoga, are helping me now. I breathe deeply and notice how I feel moment to moment. I connect with my Divine guidance, and the messages from within. Lately my menopausal need to follow intuition AT ALL TIMES has coincided with the culmination of all the prosperity practices I have done over the years. We have enough money for me to only work when I feel inspired. It is lovely and what I have dreamt of for years! You know our journey. We have built wealth from scratch as artists, coaches & entrepreneurs. No trust funds or corporate jobs here. We have intuitively found investments that align with our values. I teach artists & entrepreneurs how to do this themselves. If curious, please read my previous blogs or check out my book, Give, Save, Spend; How to Build Wealth and Change the World. Our culture devalues music & art, writing, spiritual teaching, and coaching/counseling. That is backwards. In my world, those things are the most important for the soul. And these are things I have always made money at. You know the old story of the "struggling" artist or the "poor as a church mouse" minister? That is an old story. We are turning the marketplace into an intuitive place. Heart-centered entrepreneurs are actually changing the world because we create value in the marketplace out of what has heart & meaning. So how can you follow your intuition while building wealth? And have your heart-centered business be intuitive as well as profitable? Here are my tips from 25 years of spiritual and practical prosperity practice WHILE making money as an artist, teacher & coach: Have a centering practice. The breath is your friend. Even 5 minutes of breathing to notice how you feel in your center is incredibly powerful. Many people do much more than this with extended prayer, yoga or meditation. But even 5 minutes is a start. This helps you to know your true inner feelings. Journaling and walking are other ways to tap in to how you feel, and release any negative feelings to feel good again. Have a positive thought practice. Train your mind to be in alignment with your inner feelings and desires. Choose positive affirmations for your life and your business that reflect the life you want! I have used a simple Affirmation-Intention-Gratitude practice from Unity Church for 17 years and it is very effective for me in training my mind to see good outcomes. Have a generosity practice. I have been a tither for 17 years, giving 10% of my income away. This giving helps you align with your spiritual inspiration, and know where your intuition is guiding you to be learning. Tithing also creates money miracles. Tithing also heals the "starving artist" mentality if you have that It turns your life into a garden of abundance! Find places to give that inspire you and are doing uplifting work in the world. Feed your creativity. Your inner child of intuition loves to be delighted! For 25 years I have taken my artist child to places that inspire her~a funky thrift shop with household treasures, a special church service to hear the organ & choir sing, a dance or art class, a walk in the woods. We need to nurture our inner inspiration, and that sense of fun and delight that we felt as a child. Even a few dollars for art supplies, or a new musical tool, can be incredibly nourishing to your soul and intuition. Have an integrity practice. Notice your true "yes" and true "no" coming from your intuition. It often helps to have an accountability partner for this, a friend, or coach. When you commit to something, really commit to it. And then keep showing up for yourself and what you have committed to. And then notice where you need to say no, what is not working for your spirit. Call yourself on your own bullshit. Practice boundaries. Have a saving practice. This is very practical, but supportive to your intuition. It is a lot easier to follow your inner guidance when your life is less stressful. Build your emergency fund, then begin investing according to your values. Savings brings incredible peace of mind. And investments give you time freedom, to do more of your heart's desire. All of these practices support your soul, your heart, your intuition. You are always being guided by your inner feeling, and your connection with the Divine. But the practices help you be more able to listen. In our busy lives, stopping to LISTEN is often the hardest, but most important, thing. That is one gift of the pandemic: we all had to slow down, whether we liked it or not. Finally, to have your intuitive gifts honored in the marketplace, I recommend 3 things: Insist on your value. One thing I notice is that heart-centered workers are sometimes exploited in the marketplace~not on purpose, but by default. The heart-centered person is a giver. We tend to also exploit ourselves by neglecting our own needs~for greater income, for space & time away from work, for self-care. You can honor yourself by insisting on market value for your services and your gifts. The act of commitment opens up doors for you. As Wayne Dyer once said, "you have to believe it to see it." Choosing to value yourself means you will attract people and situations who do the same. For me, this choice to value myself has meant that I continue to choose being self-employed, as that gives me the most freedom, respect, and the most income! Have a consulting mindset. My whole life I have been a consultant, and it has been extremely freeing. A consultant shares their gifts, but has flexibility and freedom to move and change the conditions of their employment when their intuition changes. A consultant also can charge top dollar for their services, knowing they provide expertise in a special niche. And a consultant knows their income comes from God and the Universe, not any human person. There is more a sense of infinite abundance. Even if you are an employee, if you think of yourself as a consultant, you open yourself more to other intuitive opportunities for creativity and prosperity in your life. Suddenly, the job is "one source" of your inspiration, not the only one! Uplift other heart-centered professionals. Many healing and artistic professions have been historically feminine, and places where women excel. We are the caregivers. Not that there aren't caring men in these professions, but the majority historically have been women. The devaluation of heart-centered work and the devaluation of women's work have gone hand in hand. Rather than exploit these precious people, we can cherish them. Insist on benefits, support, and abundant rates for all counselors, artists, musicians, consultants, healers, authors, teachers, ministers & coaches. Instead of paying these people a stipend when you hire them, pay them generous market rate that includes up-to-date adjustment for inflation/cost of living increase. Create opportunities that support the heart-centered professional as the "heart" of a community that they are, and help them have an abundant income including financial support for retirement. Thank you for having the courage to follow your intuition. I know it is guiding you to an even more wonderful life and a thriving heart-centered business! I can't wait to hear what happens for you! Love & blessings, Kathy Well, we did it! We bought a property with a primary residence(door #1) and a rental(door #2) in the very inflated market of Ashland, Oregon. Ashland is an area that has become like many desirable towns in the west, extremely expensive and competitive. The average home price here is $500,000. It was always my dream to own a home here. The schools are good and it is a great place to raise kids. It has a great walk-able downtown, with lot of character. The town is home to all kinds of artistic & healing pursuits: from the Oregon Shakespeare Festival to the Conscious Living Fair. But when I came to Ashland as a single mom, that dream was out of reach. And it is out of reach for many regular working people, who choose instead to live in Medford, where the average home price is closer to $300,000. I believe that as we prosper, we have a responsibility to lift others up. So this blog is for all the self-employed friends who want to buy homes in inflated areas. You can do it, it just takes time. So how did we get here? #1. We tracked our money. Tracking our spending and self-employed income was a prime factor in our success. We use household budgeting software(www.everydollar.com) and business budgeting software(Quickbooks & Freshbooks). Tracking our household ins and outs helped us to "make margin", which is the process of creating cash flow I talk about in my book. And tracking our business ins and outs helped us make our businesses profitable, as well as set us up well for tax time. Having good records of self-employed income for at least 2 years is required to get a home loan. Before 2008, "stated income" loans were allowed, but no longer. Since that market crash, lenders are much more strict, and they want to see good net income(after business expenses) to be able to lend. Also, with properties that already have rental income you can count 75% of that rental income toward the loan. #2. We worked our butts off! Both my husband and I have "multiple income streams", another process I talk about in my book. This works well for us, especially in the semi-rural area of Southern Oregon. We find money in many places: our various businesses and investments. We both have worked very hard over 9 years to grow these businesses, and make them profitable. When the economy tanked with COVID, and our regular businesses were challenged, we turned to new income streams and beefed them up. Shifting to respond to market changes has always worked for us! At the end of the day, we had about 8 different income streams in 2020, all of which contributed to help us qualify for the loan! 3. We saved money. We made saving a priority. Every month for years and years we set aside money in our budget: for the debt elimination, emergency funds and investing I recommend in my book. Then after that, our down payment grew: we built equity in the manufactured home we had purchased for cash by renovating it, and invested in other projects that brought a great return. We made sure to up our home insurance to reflect our home's higher value. We increased our net worth by hundreds of thousands in 5 years. On top of that, we received a little extra money from our home insurance payout after the wildfire(see the next section on giving & windfalls). In addition, our other investments did well, and we added that cash to our nest egg. We wanted to be sure to have enough for a 20% down payment AND plenty leftover to continue to invest. 4. We gave money away. This may seem counter-intuitive. When you are saving to buy a home, why give money away? Well, again this is something I teach about in Give, Save, Spend. To give 10% of your net income away is a very high practice. It helps you in your personal growth to give to where you are inspired, and also grows your abundance mindset, and your ability to receive. We found that giving away 10% of our income, time, and energy to the inspirational places & charitable causes we believe in brought us blessings. We felt abundant and relaxed, rather than tight and fearful. And giving brings miracles! In addition to our regular income, we also sometimes receive windfalls and unexpected income. And investment opportunities seem to always fall in our lap. 5. We had professionals help. We relied on the help of an accountant, bookkeeper, realtor, home insurance agent, and loan officer in this process. It helps to have a team! Our bookkeeper and accountant helped us in the years of preparation, to have good business records and complete taxes. And our accountant helped draw on that background to help us with last-minute requests from the lenders! It was very valuable to have her in our court! As we built equity in our manufactured home investments, I made sure always to insure them for full market value, and our insurance agent helped us do that! Our realtor was aware of our situation, of wanting to live in Ashland, but keep our mortgage low. So for many months he showed us primary dwellings & rental properties. While I was the one to find this particular property, our realtor helped us gain an accepted offer, and managed the details of closing. Our loan officer got us a pre-approval many months before, so that we could confidently shop for homes. He then helped us with the huge amounts of self-employed income paperwork required for closing. So now you know a little bit more about "how the sausage was made". It was steady work over the course of many years, not an instant miracle. No trust funds here. We are just regular working people with a heart for our clients and for doing good in the world. But we were able to create continual results over time. This is possible for anyone! I hope hearing our story can inspire you. It is my passion to help heart-centered entrepreneurs get ahead, so you have plenty of resources to fulfill your mission. Build Wealth, and Change the World. Blessings, Kathy Kali After 15 years of coaching, I have stopped giving away my most valuable wealth-building support for free. My clients increase their net worth by between $5000 to $100,000 while in class with me! And they go on to use the tools I taught them to build million dollar nest eggs and do generous giving. Pretty valuable stuff, huh? Generally in my business people do value me and pay me well. Unfortunately last year I made a mistake, and in some areas, I gave too much away. I gave away information for too many months, and discounted classes in order to "help" my community. Sadly, this made my business lose momentum. Everyone expected my help for free or cheap. They were building wealth like crazy, but not compensating me in fair measure. I had to set some boundaries, and get back to charging good rates. Don't get me wrong~there is a benefit in giving.......UP TO A POINT. But after that point, giving does not create value for your business, it devalues your business. In this blog I will explain what kind of giving is good, and will help you grow. And I outline the types of giving that are bad, and will undermine your business. GOOD GIVING: Giving 10% of time, talents & treasures(money!) away to places that inspire you and do charitable good in the world. Tithing, or giving 10% away, is a powerful practice...for YOU. Generosity makes us wealthy instantly because it affirms that we have something to give. When we give away something we formerly thought of as scarce, we reframe our experience of it to be something of which we have plenty. When we give, we open up space to receive more of what has been given. I have given 10% of my money, time & talents away for 15 years. It is a great practice! Giving a little helps dissolve blocks in our business. If you are stuck in your business, and need a breakthrough, giving can help you move to the next level. It moves energy. A woman was experiencing business blocks, and I advised she give away 10 free sessions(she had not been giving anything away for free previously). It shifted things for her, and paid clients started showing up! If you do not do ANY free giving, I recommend the following: 1. give to inspiration~Share 10% of your time(and money!) with places that feed you spiritually and help you in your own personal growth. This kind of giving is always fruitful. You are giving back in gratitude for what you have received. And you will receive blessings from the universe in return. 2. give to charity~share some of your 10% with places that are doing good work in the world, or to uplift the disadvantaged. I have given free coaching in the past to single mothers, and most recently gave a lot of my time away to help low-income people find new homes after the Alameda Fire. This feels good, and made me happy! 3. keep it to 10%~just give 10% of your time and money. More than that will eat into your income potential. But giving a little in this way keeps our hearts open, helps our communities, and keeps things circulating in our business. 3 Types of BAD GIVING: 1. Giving away your expertise constantly for free to friends and family You know this one, right? Friends and family will often ask the health coach "What should I eat this week? How can I lose weight?" and you feel you owe them your ear. But that's not the case. You don't owe them anything! Often free advice to friends & family can turn into hours and hours of unpaid labor, which does not help you build your business. As a money coach I get this all the time. My friends are always asking me money questions. I gave ongoing free advice to a friend that was already prosperous; ie, they were not a charity case. I helped them up their net worth by $75,000 dollars! Normally as a coach I would get paid a small percentage to get them the kind of huge results they did, but they did not offer to pay me a dime! And I realized it was all my fault. I had "trained" them to expect advice for free. Remember, you are in business to make money based on how you help people get results, and if the people around you respect you, they will understand that. Now when friends & family ask me questions, I refer them to my blog, my e-book, or my Wealthypreneur facebook group! I have created plenty of free material that does not require me to give away my time. And people that want my time now, are willing to pay for it, knowing I help them get results. If you find yourself constantly helping friends and family for free, I recommend the following: *get a testimonial~"Normally this is my paid offering, but I will give you a free session in exchange for a testimonial!" A lot of times friends & family are not aware you need testimonials, and will happily agree to help you. This is good when your biz is new. *set a time limit~"I usually get paid $200 for this, but I will give you 30 minutes of my time." And set a limit on the number of times you will do this. Like 1 or 2. *just say no~"I don't have time for free sessions right now, I am focusing on my paid clients." Move on, and move forward. If this person really wants your help, they will be willing to pay for it. 2. Giving away the majority of your content for free on the internet Many of us have done this in the "age of COVID". Social media has been flooded with all the free offerings generated during the pandemic. But it often can bite us in the butt. Giving away everything for free, and then trying to promote a small paid offering doesn't work. When the pandemic hit, I spent a lot of time giving away free content on social media to help others. In the beginning this was my "tithing 10%", such as the material I shared on Financial First Aid to help struggling business owners. That was a freely given gift of charity. But then I went on to share information, articles, interviews & blogs in my facebook groups for free for the rest of the year, and did not enroll any new clients! My giving went overboard, and hurt my business. I had to get back in action enrolling people at good rates. While some during COVID lost income and had to scramble, many Americans actually did well financially during lockdown. The "I can't afford it" excuse was not always valid. If you find yourself constantly posting free content on social media and NOT enrolling any clients, I recommend the following: *post a simple tip~you can still give, but keep it simple: "Here is 1 way to lose weight you can try right now" or "Here is a money tip for Spring!". Don't give away your whole transformational system. Save that for the paying clients. *free, then paid~share a free offering, such as a free talk or blog post or article, and THEN sign people up for your paid offering. Don't wait too long after your freebie to sell your paid offering, or offer too many free things. Then people forget you are actually in business, and think you are just a source of freebies! *monetize your "freebies"~If you have shared a lot of free content already, you can gather it and use it as value-added bonuses for your current clients, or even assemble it into a group program. Monetize that shit! Be sure and gather it in an attractive way, perhaps in a private page on your website or a private social media group, and delete it from public social media. 3. Giving away free classes & sessions or lowballing them I made the mistake of doing this at the beginning of COVID. I sold a class that I normally sell for $150, for just $47. Yes, I sold a lot of the class, but guess what? A lot of the students didn't show up, do the work, or report their results! I had way more success helping people show up & get results in the last 5 years of teaching the class, when I charged more money for it. People value what they pay for. Charging a decent rate is important, not only to honor your time, but to help your clients get the most out of the work. And those that pay the most tend to also be the most grateful! Isn't that interesting? I've received the best testimonials from those clients who have paid the most. If you have been giving away your most valuable work for free I recommend the following: *identify your low/high offerings~Pin down what you do as your initial consult, your inexpensive offering, and your higher-end offering. Getting clear on this "sliding scale" helps you meet people where they are at, AND honor your own time. *private time is valuable~Charge more for private work, always. Getting your one-on-one attention & expertise should be the most expensive aspect of your business. You can charge less to run a group program because you have more people contributing smaller amounts, and of course they each get less attention. *find your "sweet spot"~The sweet spot is that intersection between what you love to do, what you can get paid for, and what other people want. Take a moment to brainstorm ideas for these three areas, and then see how they intersect. That is your offering, and you can charge market value for it. Hope this article helps you value yourself and your time. Yes you can do a little giving...in balance. And yes, you deserve to get paid for your very valuable work. Blessings and good luck! September 8th, 2020. I was literally weeks away from publishing my book when we had an unusually warm windstorm in Southern Oregon. Out my front window I noticed a plume of smoke on the horizon that appeared to be about a mile away, beyond the dry grass fields. We thought, oh how odd. We've never seen a fire in Ashland. And within 20 minutes our neighborhood was burning. I asked my husband to have our teens pack “go” bags. I hurriedly ran from door to door letting elderly residents in our neighborhood know, until the fire was 3 houses away from ours. At home my husband and I each put a cat under one arm and a computer under the other, got the kids in the car, and got out. The road out was blocked due to smoke & fire, so we followed a crowd of 15 other residents who were on foot and waited in a burned out field until the road opened up. Because we gave a ride to an elderly neighbor and her dog, we were able to save our car! We are so thankful everyone in our neighborhood made it out safely. However, only 3 out of 70 homes in our neighborhood were still standing after the wildfire raged through. In the greater valley 2500 homes were lost in the historic Almeda/Obenchain Fires that ripped through the neighborhoods of North Ashland, and the cities of Talent & Phoenix. As you can imagine this has been emotionally and spiritually devastating! The last 2 months have been a wild ride of lots of unknowns. We stayed with a friend for 3 weeks, and now are in temporary housing. We still don't know where we will live longterm. But thankfully, due to the give, save, spend method, it has not been financially devastating. Our future looks bright. *Because we are GIVERS, we have a wide and deep network. Our friends and family raised money for our most immediate needs the first month. We were so thankful! Supplies, furniture, food, have poured into our lives so our every need has been met! *Because we are SAVERS, we had an emergency fund to be able to cover not being able to work for several months, and initial costs of temporary housing, food, clothing, etc. It has been wonderful not to stress about any expenses during this transition time. *Because we were smart SPENDERS, we had bought good insurance. We received good value for our home, and are able to purchase something new. I had just upgraded our insurance a few months ago to cover the true market value of our home. Life can be stressful enough without adding financial stress! My hope for you is that you can use the GIVE, SAVE, SPEND method to not only give, get out of debt and build some wealth, but be prepared for anything! When life’s disasters happen, and they do happen, at least financial stress does not need to be one of your worries. You can focus on what is most important: the people in your life and their well-being. And YES the Give, Save, Spend Book is coming out January of 2021. Stay tuned. Have fun giving, saving & spending, and taking good care of your loved ones! Life is precious. Much love, Kathy I loved my work singing for seniors for over 20 years. I grew up in a singing family, and leading singalong was a joy! I started with 5 music clients, and grew them to 15….then eventually 50. In this business, I made 80% profit. My operating costs were only 20% of my gross income. And in my coaching business, too, the margins were good. But I had to work to get my profit to that point. For many years, I operated my coaching & healing arts businesses like they were a hobby. What I made, I spent. I bought the most expensive supplies, the most expensive advertising, rented the most expensive brick-and-mortar locations for my workshops. Even though I was able to “write off” a lot of my lifestyle, my profit margin was zero. Plus, as you know, I had debt. “I owe, I owe, so off to work I go.” This was my motto until I became a single mom. As you know, this was my “come to Jesus” moment where I saw the old way was no longer working. I had to shift my mindset. I had to become a “Wealthypreneur”. What is a Wealthypreneur? A Wealthypreneur is a business owner whose business is able to give, save and spend wisely. The business is continually generating cash flow(more income than expenses), which allows for giving, and growing wealth through debt elimination, savings(retained earnings) and assets. It’s aligned with your purpose, and supports you in serving your clients in a heart-centered way, knowing your money is taken care of. Why does it matter? THE BIG PROBLEM I’M SEEING IS A DESIRE TO CONTINUE TO SERVE THE CUSTOMERS WE LOVE SO MUCH BUT… In a normal economy conscious entrepreneurs often invest in training, coaching, equipment and supplies with a dream in their heart to serve and to give~spending up to $15K, $20K even $100K to support their entrepreneurial dream, which sometimes puts them deeply in debt. What you are not getting is a simple process for how to deal with money to avoid debt in the first place, and build wealth. So you end up spending that money to grow our business only to find yourself struggling to have savings, buy a home or invest for retirement, and have enough cash flow to put your kids through college. Some of you struggle to keep your business doors open due to how much debt payments eat up your cash flow. And then, in economic downturns, those debt payments become a crushing burden for your biz. You must take responsibility for your business numbers! Even if you have a bookkeeper or accountant, it is up to you to look at your numbers and make crucial decisions. Many small business owners abdicate this responsibility. Instead of abdicating, I recommend you embrace this role! Become your own CFO! As a heart-centered small business owner, you probably don’t even know what a CFO is, right? CFO means Chief Financial Officer. The CFO does more than just a bookkeeper or accountant who tracks numbers and prepares reports. The CFO keeps financial integrity for the business. The CFO makes sure profit margins are maintained and the business is not going into debt. A CFO is not judgmental, but objective & kind. Understand Profit How do you become your own CFO? First of all, you need to understand profit. Most small business owners don’t even know what that is. What is profit? Profit is the money in your business that is not used immediately for business spending of one kind or another. In its basic form it is your salary, your takehome pay. In its advanced version it is not owner pay/salary, taxes, or operating expenses. Profit is EXTRA money that does not need to be used for living, giving, or running your business that month. In that more advanced sense profit is used for business/personal savings & investments, and for investing in longterm business growth. So for example, a business that grosses $5000 a month and has $2000 operating costs has a basic profit of $3000. $3000 is your take-home pay, and you pay taxes out of that. However, if we separate out take-home pay, taxes, and operating expenses, we might get an actual profit of 5%, or $250, the amount the owner is able to literally save and put into their household savings & business retained earnings that month. A basic way to track profit is with the 70/30 Rule. The 70/30 rule means that 70% of your income goes to take-home pay, 30% goes to operating costs. Then savings and investments come out of the 70%. Profit helps you grow your business, and your personal wealth. An advanced way to track profit is with the Profit First system, invented by author & teacher Mike Micalowicz. Mike encourages business owners to breakdown their income like this: 5% True Profit(amount you can save & invest), 50% Take-home pay/salary(for lifestyle), 15% Taxes(put in a separate savings account), and 30% Operating Expenses. Basic Profit and Advanced Profit I recommend bookkeeping software to track all these numbers every month. Quickbooks is the industry standard, and many bookkeepers use this system. However, it can be overly complicated for many service-based businesses with just 1 employee, the owner. If you do not have inventory, or employees, I recommend Freshbooks, a very simple & user-friendly system that does invoicing, and profit/loss reports. And if you are just getting a business started and have very low overhead, you can even use Everydollar, the personal finance software, to keep track of business expenses under $500. Another common way businesses track profit is through a “profit & loss” form. This form is easy enough to create yourself in Excel, and is readily available in Quickbooks & Freshbooks. A Profit & Loss form is helpful if you are using the Basic Profit system, or 70/30 rule. The final net profit number at the bottom should be ideally 70%. Once you understand profit, you can assess whether your business is a hobby, or profitable. Wealthypreneur Russ Schweikert says “Don’t pretend it’s a job when it’s a hobby, because chance is, you’ll go months and years doing it and you’ll wonder what happened and you let it overtake you. And then you’ll somehow feel guilty because you have to let people go and close the business. And what you’re trying to do is help people and make money.” I agree with Russ. Find out your true profit margin so you can answer the question, “do I have a business or a hobby?” Once you know, then you can make an empowered decision. For years I resisted savings because I felt guilty. Who am I to have abundance when there is so much poverty in the world? How can I develop assets when others have none? My heart for others made me averse to savings.

And so even though I had made a half million dollars in my working lifetime, I was still “bleeding” my money away: with out-of-control spending, the debt game, and no plan. It took developing a giving practice and also being close to poverty as a single mom to help me feel deserving of savings. Being close to poverty was a big wake-up call for me. Saving meant the difference between paying for food out of pocket and foods stamps. Saving meant choices about what kind of work I did. Saving meant security. Out of this experience I began to realize that I can give AND save. Giving helps me feel I am making a difference, and contributing to my community and my world. And Saving helps me feel secure. Once you are motivated to save, there are some basic things to focus on that involve creating security, and then building a legacy. First focus on your 4 Walls, or the basics of your household. Next, focus on Debt Elimination, so debt is not eating up your wealth. Then save an Emergency Fund of 3-6 Months of Expenses in Savings for both Business and Household, so you are secure for any storm(we saw the importance of this with the COVID-19 slowdown!) After that focus on purchasing a Home because owning a home statistically boosts your wealth. And finally focus on Retirement Savings, so you have choices for your future and can build a legacy for your family. So what are you waiting for? Start piling up cash! It is possible, even in an economic slowdown. Yes downturns happen. We’ve seen this with the Coronovirus. But you will get through this. Just as I got through being a single mom. No season lasts forever. And hopefully this will be the time you say "never again" to being in debt with no savings. For now, keep your attitude positive and keep looking for the silver lining. Stay in touch with those who cheer you on and want you to succeed. And just start saving. THE SAVINGS STEPS: 1. STABILIZE YOUR HOUSEHOLD If you are low-income, or in crisis, I recommend you start with the 4 Walls. Start with taking care of your castle first. Then you can start giving and saving. The 4 Walls are: food, shelter, transportation and utilities. Place all debt payments on hold if you need to as well. Talk to your landlord/mortgage company if you need to defer payments. Most reasonable people will work with you. Go to the food bank if needed. See if you can carpool or reduce your transportation costs. Talk to your utility company so you can keep the lights & water on. Once your household is secure, the first saving step is to accumulate $1000. We talked about this in the “Making Margin” chapter. This beginning emergency fund will help you deal with small emergencies and keep them from destroying you. Sell stuff online, take on a side hustle, cut out all unnecessary bills, etc. Review “Making Margin” if you are not sure how to save $1000. 2. FULLY-FUNDED EMERGENCY FUND The next step is to accumulate 3-6 months of expenses in savings. This bigger cushion will be the biggest gift you can give yourself. Believe me! Once I had this fund, as a single mom, I relaxed in a place I didn’t even know I was tense! I finally felt peace of mind. My clients report that they have fewer “emergencies” once they have built the emergency fund. Rather than being a negative attractor of danger, the fund seems to repel problems. And when problems arise, they can be handled with a lot less drama. When we save, we create security. Statistically, most people will have a negative financial event(divorce, death in the family, economic downturn, loss of work, illness, etc.) at least once every 10 years. In the past, I thought if I only “thought positive” enough, I would not have any emergencies. I actually thought an emergency fund would create problems for me! While I do believe positive thought in general is very important, this reliance only on positive thinking was a little naïve. Have 3-6 months of expenses in the bank~average household has $10,000 *Ask yourself, “What would it take for me to live for three to six months if I lost my income?” Your answer to that question is how much you should save. Use this money for emergencies only: incidents that would have a major impact on you and your family: unexpected household repairs, car dying & needing to be replaced, medical bills, etc. Keep these savings in a money market account. Remember, this stash of money is not an investment; it is insurance you’re paying to yourself, a buffer between you and life. *This savings is essential before you start investing in assets such as real estate, or investing in the stock market, because it is liquid cash. Investments are often not quickly liquidated. *$10,000 in the bank is an average household emergency fund. Some people want a little more, a little less. If you have a very secure job and your spouse is working, you can lean toward 3 months of expenses. If you are single or do not have a secure job, lean toward the 6 months rule. How much do you need each month to cover your expenses? Multiply that by 3 or 6 to get your “Fully-Funded Emergency Fund” number: Suze Orman recommends people have 18 months of expenses in savings. If you want to save that much for your security, go for it! I personally found that saving 6 months worth, and then going on to save for a home and start investing gave me more momentum. Since then we have gone back and “beefed up” the emergency fund to be a little larger than it was before. "Failure means a stripping away of the inessential." ~J.K. Rowling

My whole life, I was set up for success. I was the "good kid" while my brother was the wild one, always doing what would make my parents happy. An oldest child of a family who valued education, I went right to college after high school. I rebelled a bit in my 20s by pursuing the arts, music & dance, without much financial success. But I returned to the people pleasing of my childhood by marrying a wealthy man and having children by the end of the decade. I built a successful small business in the healing arts & coaching in my 30s, and maintained a 5 bedroom house on 8 acres. It seemed we had it all. Then failure came along and changed my life. The underpinnings of my marriage began to unravel....my business was mired in debt....our remote rural neighborhood couldn't support my business....and then I began the arduous, slow process of losing everything I had. With the help of my prosperity coach Toni Stone, I got the courage to let go of what was not working. I lost the marriage, and became a single mom. I lost many friends & clients when I moved from a rural neighborhood to a progressive town. Although I had always made good money, due to my debt load, and out of control spending, I could not afford to buy a home for myself and my children. And then my income itself began to disappear, and I faced real poverty as a working single mom. But becoming poor was one of the best things that could have happened to me. I began to look in the mirror and see what was really going on. I discovered my people pleasing was actually a fault. When I took a Debtors Anonymous course, the common theme in myself that I discovered was "lying". I was "lying" in order to be loved. I took on debt, and spent more than I had, to please others, and appear wealthier than I actually was. A lot of my lifestyle was based on trying to make up for a deep insecurity. I began to really grieve for the loss of the marriage, and to grieve for many pains that I had experienced in my life. Instead of masking my feelings, I began to speak them, and let people know when they hurt me. I woke up to how I was medicating my grief with purchases, and I stopped the out-of-control spending. When I did the math, I saw I had wasted about $75,000 in "people-pleasing"! What I found so personal and shameful is actually a cultural problem. Most Americans try to “keep up with the Joneses”. And since 75% of Americans have consumer debt, that means the Joneses are in debt! And we are all comparing ourselves to each other! We look at each other's social media feeds to see how great other people are doing, and how poor we are doing. And it's an empty shell game! Who was I really impressing with my large lifestyle? I realized that for years buying the newer car, the bigger house, the prettier clothes, etc. never brought me happiness. The folks I was trying to impress never stuck around. And my true friends are with me no matter how much money I have. That was a real shocker. J.K. Rowling, who wrote the Harry Potter books, said of becoming a poor unemployed single mother: "Failure gave me an inner security that I had never attained by passing examinations. Failure taught me things about myself that I could have learned no other way...I also found out that I had friends whose value was truly above the price of rubies." And so rock bottom became the solid foundation on which I rebuilt my life." And so did I. I began to rebuild my life. I no longer cared what other people thought. My own financial well-being was more important to me than what I looked like. I cut my budget drastically, rented out a room, and hustled in my business. I stopped going out. I stopped buying extravagant gifts for others. I paid off $20,000 in debt in one year, and saved an extra $20,000 the next year. I joined forces with my boyfriend who lived next door, and eventually became my husband. Together we upped our net worth by $200,000 in 5 years. So if you are facing debt, low income, unpaid bills, low-to-no savings, or financial failure of any kind, congratulations! It may be painful, but failure is nothing to be afraid of. Trying to pretend everything is fine, and continuing to drive yourself into debt, now that is a real danger. Failure can be a blessing. It just might lead you to a new beginning. A PLAN TO ELIMINATE DEBT Dumping debt is an important step for building wealth. Once you are out of debt, you have real money, and that money can grow into a sizeable nest egg. My favorite get-out-of-debt system is the Dave Ramsey method:

Dave Ramsey is one of my mentors, and I hold his coaching certification. He admits he did not invent the “baby steps” above, they are classic personal finance wisdom from the last 50 years. However, he is famous for packaging and sharing them in such a way that has helped millions of people build wealth. What I love about this method is its step-by-step nature. For years I tried to do everything all at once: pay off debt, save for retirement, fund my small business, put money in savings, etc. And I was getting NOWHERE. Saving $1000, paying off my debt and then saving the emergency fund was an easier path for me. In addition, the debt snowball method was more effective for me than paying off higher interest rate credit cards. It helped me feel excited and motivated! Why eliminate debt? *Debt reduces cash flow. When you have debt payments, they eat up your take home pay, which affects your ability to save & build wealth, and also have a good lifestyle. If you have a small business, debt payments eat up your ability to pay your employees, cover operating expenses, and save for wealth-building. During economic downturns(Coronovirus, anyone?) debt marches along, becoming a crushing burden. *Debt reduces wealth. When you have debt, it subtracts that amount from your net worth. For example, you can have $50,000 in your Roth IRA, but if you have $50,000 in debt, you actually have a ZERO net worth. Wealth is important for your retirement, and it also protects you from risk. Real assets bring stability during downturns. Debt doesn’t. *Debt increases risk. When you are in debt, you are at greater risk of losing your home, and other assets, in the case of an emergency, such as a health challenge where you can’t work, or an economic downturn in which you lose your clientele. We saw many people who had too much debt on their homes lose them in 2008. 10 million of them! And we know large emergencies happen for most of us every 10 years. It’s not a question of if, it’s a question of when. *Debt masks profit. When you have a small business, debt makes it hard to tell what your actual profit margin is. Say you put a piece of equipment on the credit card at $2000, and pay $100 a month on the bill. You might bring in $100 more a month based on that equipment. But when you deduct the debt payment from the income, your profit is actually zero. The Debt Snowball METHOD: Pay off all non-mortgage debt using the Debt Snowball method. The “highest interest rate first” method IS mathematically correct, but it often doesn’t work because people lose momentum. The debt snowball method gets you fired up!! And it works to get the job done! Plus, most people pay off their debt within 2 years of doing the snowball intensively, so the amount of interest paid is not crucial. List your debts, excluding the house, in order. The smallest balance should be your number one priority. Pay the minimums on every debt but the smallest~pay as much extra on that as you can to pay it off quickly! Then attack the next one on the list. When you start knocking off the easier debts, you will see results, have more money to throw on the next largest debt, and you will stay motivated to dump your debt. |

Details

Kathy KaliCoach. Teacher. Author. Speaker. Archives

March 2024

Categories |

RSS Feed

RSS Feed